Graduate roles are pacing at the weakest level since at least 2018, according to Indeed’s Mid-Year Labour Market update. As of 13th June, they are down 12% on last year as a share of all jobs (grad jobs are down 33% in absolute terms) and are pacing even below their share in 2020 and 2021 when pandemic social distancing made it difficult for employers to assimilate new joiners.

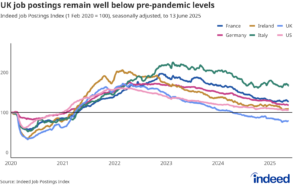

The scarcity of graduate positions comes amid a labour market where many employers have been holding on to existing staff while cutting back on new hires. In line with this, overall UK job postings are down 5% on their level at the end of Q1. They now sit 21% below their 1st February 2020, pre-pandemic baseline. The UK remains an outlier among peer economies in Europe and the US, being the only country tracked that has not recovered from pre-pandemic levels.

The UK labour market continues to loosen, with the ratio of unemployed people for each vacancy increasing from 1 in 2022 to 2.2 as of April 2025. Yet it has seen a continued gradual softening rather than a steep decline despite headwinds such as the policy-driven rise in employment costs and global volatility.

Despite concerns that April’s hike in employment costs may have led companies to lay off staff, the number of potential redundancies notified to the government has remained low at around 25k per month, with little sign of any uptick in recent months.

Defiance in face of RTO

The share of UK job postings mentioning remote or hybrid work remains high at 15% as of end-May, down from a peak of 16.6% back in March, but well above the levels of around 3% seen pre-pandemic.

Despite attention on return-to-office (RTO) calls from a number of businesses, remote, and hybrid work continues to be widely offered, even in categories such as banking and finance (39%, down from a peak of 45% in February 2024).

Nursing and remote-friendly roles decline, while retail and hospitality weather headwinds

Prior to April’s rise in employment costs, there were warnings that the changes could lead to large reductions in retail and hospitality headcount. Despite this, jobs in these sectors have not seen outsized declines, with retail postings down 2%, while food service is down 10%, and hospitality and tourism down 11%. Together, those categories account for just over one-in-seven UK job postings.

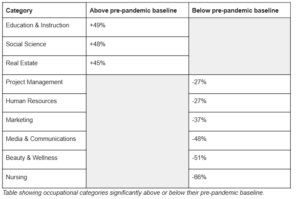

Job postings remain softest in occupations that traditionally offer the greatest remote-work flexibility. In addition to ongoing weakness in tech roles – the most remote-friendly sector – several professional categories are also underperforming the national average.

However, it is the nursing category where postings are furthest below baseline, followed by beauty and wellness. While categories where job postings are furthest above the baseline are education and instruction, social science, and real estate.

Reflecting their greater exposure to weakness in professional occupations, job postings in the South East and London (down 32% and 29%, respectively, from their pre-pandemic baselines) continue to underperform other regions. Northern Ireland (+19%) and the North East (+4%) are the only regions where postings remain above pre-pandemic levels.

Additional findings

Ahead of proposed legislative changes around zero hours contracts, the share of job postings mentioning zero hours arrangements has started to ebb, standing at 1.8% as of May. That’s down from a peak of 2.2% back in January.

Job postings related to generative artificial intelligence continue to grow rapidly as organisations continue to develop and integrate the new technologies in their businesses. The UK has emerged as an early leader among large developed economies, with GenAI jobs now representing 0.5% of all postings, as of end-May.

Jack Kennedy, Senior Economist, Indeed, commented: “The UK labour market headed into 2025 amid expectations that it would be a challenging year. Approaching mid-way, that’s largely proven to be the case. That said, it has weathered headwinds such as the policy-driven rise in employment costs and global volatility, in that it’s been a continued gradual softening rather than a nosedive.

“While hiring appetite is weak, job losses have remained modest and the labour market is still somewhat tight by historical standards, supporting gradually easing but still strong wage growth. Despite the UK labour market holding out overall, new entrants like graduates face a challenging time in securing a first rung on the ladder. This signals a wider landscape of employers holding onto existing staff, while some observers contend that entry-level roles in professional occupations are particularly exposed to AI displacement.

“Although there’s been much attention on the RTO, remote and hybrid postings are holding up. For employers, offering flexibility remains a powerful tool for recruitment and retention. While a continued softening of the labour market may give further leverage to employers, workers continue to strongly desire flexibility. An attractive and competitive all-round offering therefore remains key to getting and keeping the best talent.”